Navigating College Expenses: Expert Financial Preparation Recommendations for Students

As college tuition proceeds to increase, students are encountered with the overwhelming job of navigating their expenses. From tuition costs to textbooks and living expenses, the economic problem can be overwhelming. With expert monetary planning recommendations, students can properly manage their funds and make the most of their university experience. In this discussion, we will certainly check out numerous techniques for understanding college expenditures, producing a spending plan, checking out financial assistance alternatives, reducing materials and books, and managing living expenditures. By implementing these professional tips, trainees can take control of their economic journey and set themselves up for success in their academic searches.

Recognizing University Expenses

Comprehending college costs is critical for pupils and their families in order to make informed monetary decisions and strategy for the expenses linked with college. University expenditures encompass a variety of monetary responsibilities that trainees need to think about before starting their academic journey. These costs include tuition fees, lodging expenses, textbooks and supplies, meal plans, transportation, and miscellaneous expenditures.

Tuition costs are commonly the biggest cost for trainees, and they vary relying on variables such as the kind of organization, program of study, and residency status. Holiday accommodation prices can vary considerably depending on whether pupils select to live on-campus, off-campus, or with household. Textbooks and materials can additionally be a considerable cost, particularly for programs that call for specific materials. Dish plans, transport, and various expenses, such as club costs and after-school activities, ought to additionally be factored into the overall spending plan.

To gain a thorough understanding of college costs, pupils and their households need to research the certain costs connected with the programs and organizations they are taking into consideration. They ought to additionally explore prospective resources of financial aid, scholarships, gives, and work-study possibilities to help balance out several of these costs. By comprehending university expenditures, students can make educated choices concerning their financial future and make sure that they are adequately prepared to satisfy the economic needs of greater education.

Producing a Budget Plan

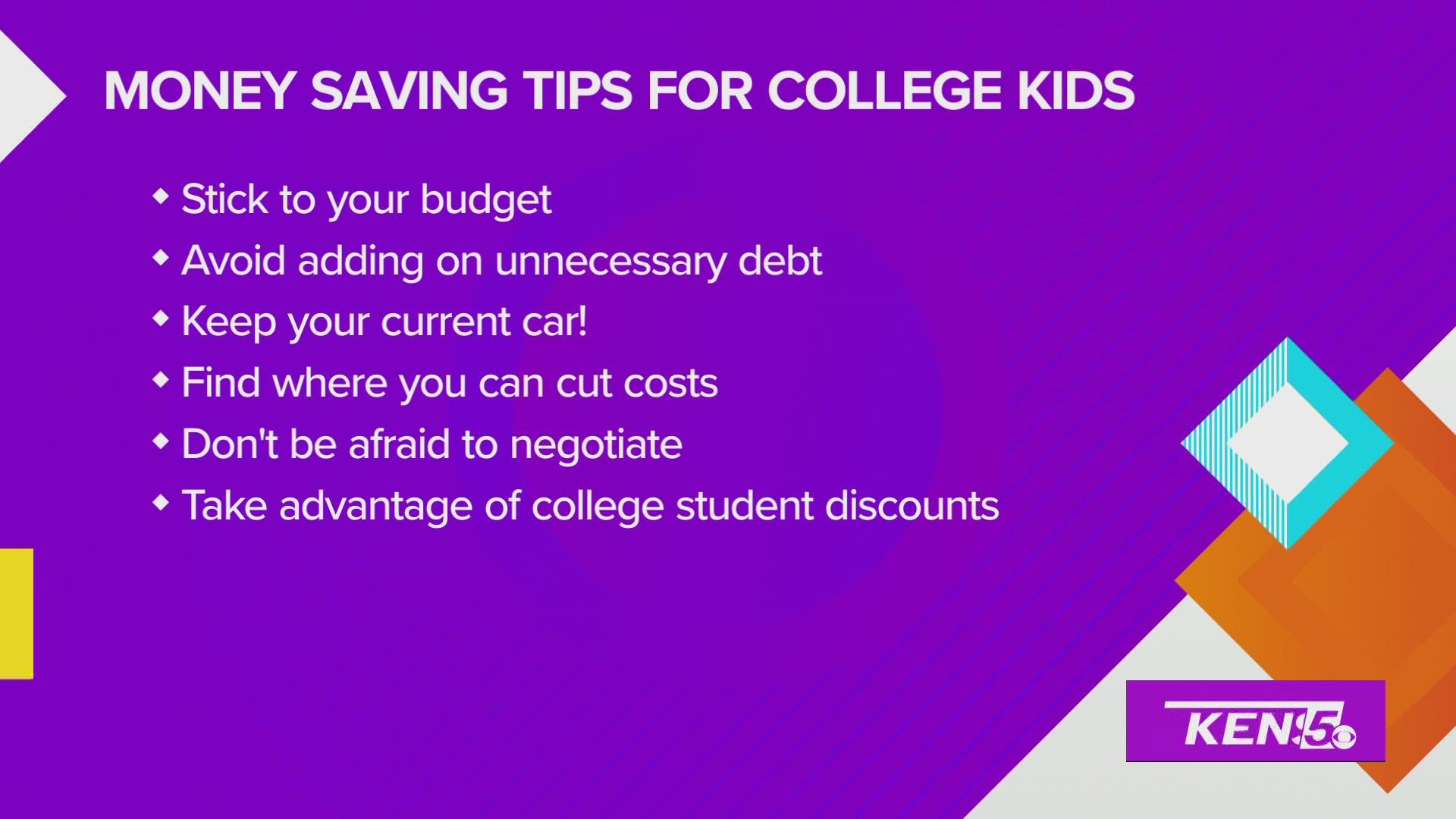

To properly take care of college expenses, trainees and their households need to develop a spending plan that accounts for all financial obligations and makes sure accountable costs throughout their scholastic trip. Developing a spending plan is an essential action in financial planning, as it allows individuals to track their income and expenses, and make informed decisions concerning their investing habits.

The initial step in producing a spending plan is to figure out all incomes. This might consist of scholarships, gives, part-time tasks, or contributions from relative. Save for College. It is essential to have a clear understanding of the total quantity of cash readily available monthly

Next, students should identify all essential expenditures, such as tuition charges, textbooks, real estate, food, and transportation. It is essential to focus on these expenditures and designate funds accordingly. Additionally, pupils should likewise consider alloting money for emergency situations or unforeseen expenses.

As soon as earnings and expenses are established, it is essential to track spending often. This can be done with budgeting apps or basic spreadsheets. By monitoring costs, students can recognize areas where they might be overspending and make changes appropriately.

Developing a budget plan not just assists pupils remain on track monetarily, but it additionally promotes accountable spending routines that can be carried into the future. By developing a budget and sticking to it, trainees can browse their college costs with self-confidence and ease.

Exploring Financial Assistance Options

They do not require to be paid back, making them an eye-catching choice for many pupils. It is essential for pupils to research study and use for scholarships that line up with their passions and certifications.

Grants are another kind of financial assistance that does not call for payment. These are typically granted based upon monetary demand and are offered by the federal government, state federal governments, or colleges themselves. Trainees go now have to complete the Free Application for Federal Trainee Help (FAFSA) to identify their qualification for grants.

Finally, pupil car loans are an additional option for financing university expenses. Unlike scholarships and grants, lendings need to be settled with interest. Trainees need to thoroughly consider their finance options and borrow only what is essential to avoid excessive financial obligation.

Saving Money On Textbooks and Supplies

As pupils discover financial help alternatives to ease the burden of college costs, locating means to minimize products and books becomes crucial (Save for College). Books can be a considerable cost for students, with rates typically getting to hundreds of dollars per publication. Nonetheless, there are numerous strategies that pupils can utilize to conserve cash on these important sources.

One more choice is to get utilized textbooks. Numerous university schools have book site shops or on-line industries where pupils can market and acquire used textbooks, frequently at significantly minimized costs.

Students can additionally check out digital options to physical books. E-books and on-line resources are becoming progressively preferred, providing students the convenience of accessing their called for analysis products digitally. Furthermore, some web sites supply low-priced or totally free books that can be downloaded and install or accessed online.

In terms of supplies, trainees can conserve cash by purchasing wholesale or making use of back-to-school sales. It is additionally worth getting in touch with the university or college's bookstore for any discounts or promos on supplies. Ultimately, trainees need to consider borrowing supplies from close friends or classmates, or making use of university resources such as libraries and computer system labs, which frequently give access to needed materials at no cost.

Taking Care Of Living Expenses

Taking care of living costs is a crucial facet of university financial preparation - Save for College. As a pupil, it is vital to produce a budget that makes up all your important living expenses, such as real estate, food, transportation, and energies. By managing these costs effectively, you can make sure that you have adequate money to cover your standard needs and prevent unneeded economic stress

One way to handle your living costs is to locate affordable housing choices. Take into consideration living on university or sharing an apartment or condo with flatmates to split the price. Furthermore, discover different dish strategy choices or cook your very own meals to save money on food costs. Transportation prices can additionally be decreased by utilizing mass transit, car pool, or biking to school.

To effectively handle your living expenditures, it is critical to track your costs and produce a regular monthly spending plan. This will aid you identify areas where you can cut down and save money. Seek student discounts Continued or cost-free events on university for amusement alternatives that won't spend a lot.

Final Thought

In verdict, comprehending university costs and developing a budget plan are critical actions for students to successfully manage their financial resources. Discovering monetary help options and discovering ways to reduce books and materials can likewise assist ease some of the monetary concern. In addition, handling living costs is crucial for trainees to stay on track with their funds. By executing these approaches, pupils can navigate college expenditures and enhance their financial health.

By understanding university expenditures, pupils can make enlightened choices about their monetary future and make certain that they are effectively prepared to fulfill the monetary needs of greater education.

As trainees check out economic aid alternatives to alleviate the burden of college expenditures, discovering ways to conserve on products and books ends up being vital.